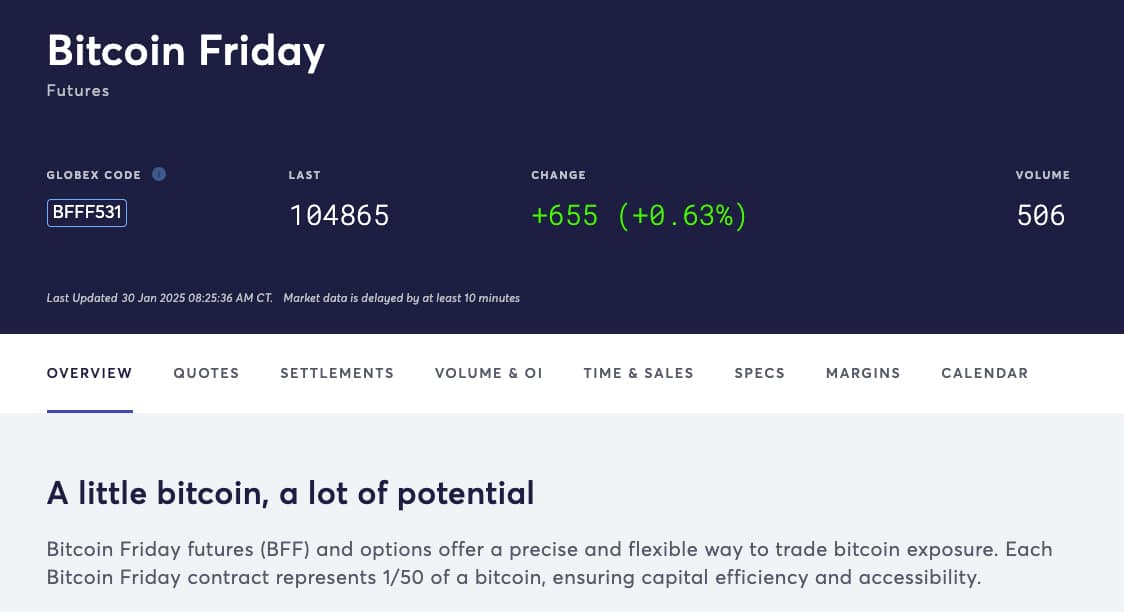

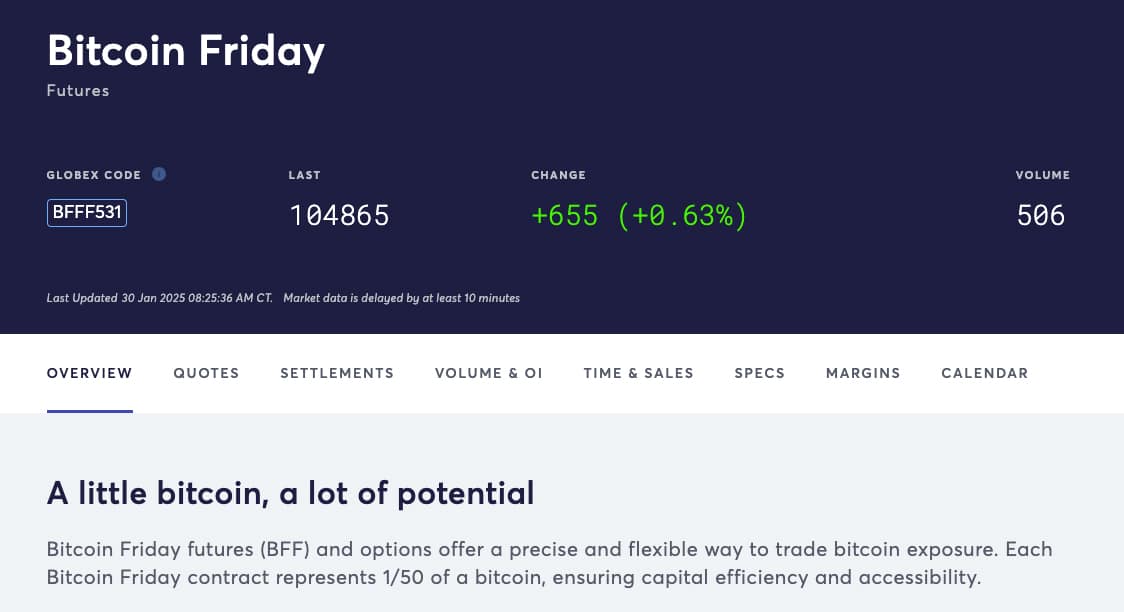

The Bitcoin Bull Run is about to be supercharged, and this time, it is not Michael Saylor. Bitcoin Friday will arrive when CME launches Bitin BFF in an important Catalyst Bitcoin Bull Run event.

As recently reported, the Chicago Mercantile Exchange (CME) The group will present options at Bitcoin Friday Futures (BFF) as of February 24, 2025, subject to approval.

This will offer merchants greater precision in the management of the short-term Bitcoin price .CWP-Coin-Chart Svg Path {Stroke-Width: 0.65! IMPORTANT; }

Price

24 h volume

?

->

Price 7d

Risks The new BFF options will be extensions of the successful launch of CME BFF, which is a bartering news for Bitcoin and Crypto in general.

Bitcoin’s price is incredibly optimistic: how CME’s BFF will aggravate Bullrun’s potential

CME BFF contracts, which debut in September last year, quickly became one of the most successful cryptographic products of the CME group.

Since then, more than 775,000 contracts have been negotiated, which has great popularity among investors. These contracts are smaller, in a 50º of a Bitcoin, and present daily maturities from Monday to Friday.

Vicious GiovanniGlobal Chief of CME Group cryptocurrency products, highlighted the precision of these new options offered by merchants.

INTRODUCTION OF THESE OPTIONS COMPLEMENTS The existing offers of the CME group, which include bitcoin options and physical settlement ether, together with micro size bitcoin and SVG SVG .CWP-Coin-Chart {Stroke-Width: 0.65! Important; }

Price

24 h volume

?

->

Price 7d

futures.

(Fountain)

In addition to the developments in his markets, Crypto also received a bullish impulse from regulatory news. The president of the Federal Reserve, Jerome Powell, recently indicated that banks could be able to offer encryption custody services.

This statement, made during a press conference, immediately pumped the price of Bitcoin.

Powell’s comments suggest a potential change in how banks interact with Crypto, offering them the opportunity to keep digital assets on behalf of their customers. He stressed that the Federal Reserve would continue to closely monitor the risks associated with crypto and/or bitcoin.

President Jerome Powell says that “banks are perfectly able to serve cryptographic clients.”

After mentioning Bitcoin, he began to increase again to $ 104K pic.twitter.com/iicnx51fyg

– Pegæ

(@ivvagiant) January 29, 2025

Before this statement, Powell had explicitly declared that Bitcoin is not a competitor of the US dollar, but competes with gold. Bitcoin describes as similar to digital gold. “It’s like gold, only that it is virtual. It is digital. “

Bitcoin has a hard limit of 21 million coins. Every 4 years, there is an “half half” event, reducing the mining reward to half, effectively reducing the new Bitcoin supply that enters the market. This shortage pushes the price of Bitcoin with greater demand. The last half of half in 2024 further reduced the emission rate, helping with the deflationary nature of Bitcoin.

While finite, the new gold is extracted annually, increasing the supply by approximately 1-2% per year. There is no incorporated mechanism as half of Bitcoin to reduce this supply growth. Gold comes from nature, and predicting its supply count is difficult, which makes it more abstract as an investment.

RELATED: Half guide of Bitcoin reduction: How long will the bull spend?

Bitcoin market capitalization of ~ $ 2T represents approximately 11% of Gold market capitalization of ~ $ 18t.

Bitcoin is a better form of money. Bitcoin exists on computers anywhere and everywhere. In the next 5-10 years, Bitcoin market capitalization will probably exceed gold.

6 reasons

The shortage: Bitcoin has … pic.twitter.com/edigqfwvyp

– ₿rian Maass (@Maasscfo) January 25, 2025

During the last decade, Bitcoin has proven to be an exceptionally higher investment compared to gold. From around $ 300 in 2014, the price of Bitcoin has expelled more than $ 100,000 by 2024, with an amazing yield of approximately 33,000%.

This means that if he had invested $ 1,000 in Bitcoin at the beginning of the decade, his investment would now be worth around $ 330,000. The gold, on the other hand, which began the decade in around $ 1,200 per ounce, has only seen an increase to approximately $ 2,200, offering a return of approximately 83%.

In comparison, this translates into an investment of $ 1,000 in gold that grows to approximately $ 1,830 during the same period.

Holding Bitcoin would have been much more lucrative in the last ten years. And no, Bitcoin does not stop soon. It is an asset of one million dollars since institutions and intelligent money join the Bitcoin car.

Bitcoin Bet of Microstrategy: Michael Saylor’s vision and its impact on Crypto Bull Run

In 1989, Michael Saylor Microstrategy co -founded with Sanju Bansal. Initially focused on data mining, the company became a leader in business intelligence, mobile software and cloud -based services.

Saylor was CEO from 1989 to August 2022, when he made the transition to the Executive President. This decision allows you to focus more on Bitcoin strategies.

Michael Saylor made Microstrategy public in June 1998, with shares initially at a price of $ 12, doubling the first day of negotiation. In early 2000, his net assets had shot at $ 7 billion, making him one of the richest in the world.

In 2020, Microstrategy announced that Bitcoin would use as its main asset of the Treasury Reserve, a decision that led to buy more than 471,107 bitcoins in early 2025, valued at approximately $ 30.4 billion.

Saylor is willing to endure the criticism of the Maxi to make Bitcoin “less incomplete”

and provide coverage to institutions to deploy capital in BTC and pump our bags

Legend

– Mitchell

(@Mitchellhodl) October 21, 2024

Saylor has become a vocal defender of Bitcoin, appearing in numerous podcasts and media to discuss its potential as coverage against inflation. Under his guide, Microstrategy has made important investments in Bitcoin.

These actions have placed Microstrategy at the forefront of the future of financial change. This indicates the question: What are you waiting for if you are not doing the same?

EXPLORE: 15 new and next coinbase listings to see in 2025

Unique the discord of 99Bitcoins News here for the latest market updates

The post CME has a secret plan to overheat Bitcoin Bull’s career: What is Bitcoin BFF? It appeared first in 99bitcoins.