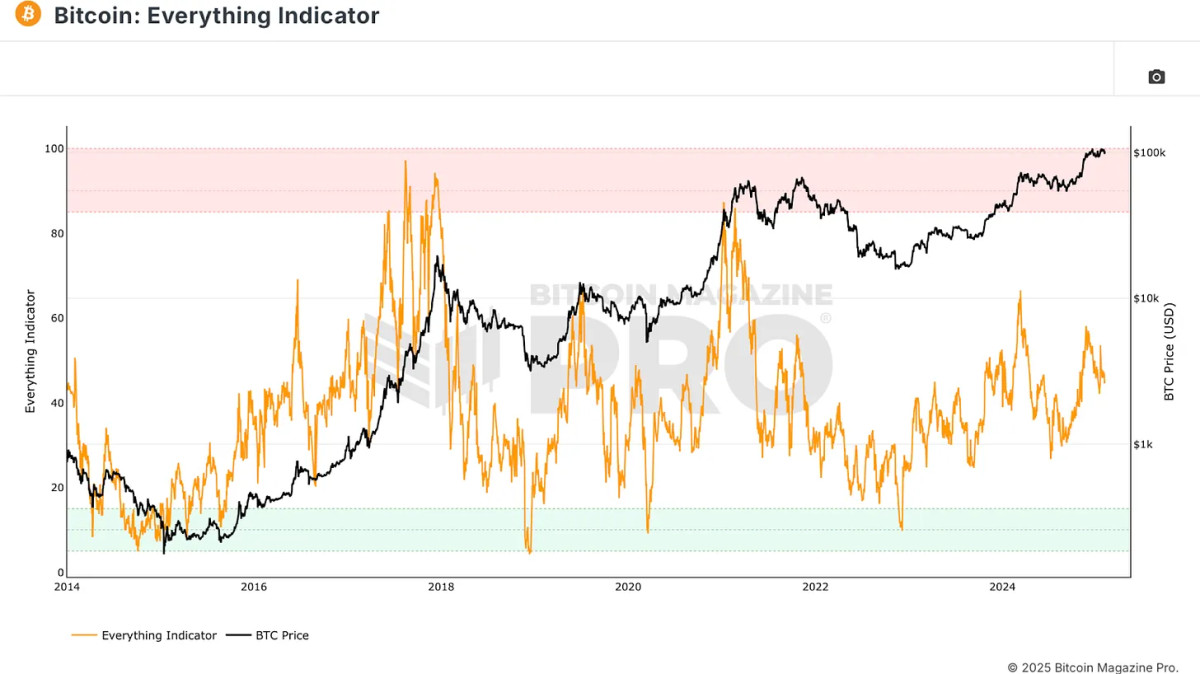

Wouldn’t it be great if we had a metric that covers everything to guide our Bitcoin investment decisions? That is precisely what has been created, the Bitcoin Everything indicator. Recently added to Bitcoin Pro magazine, this indicator aims to consolidate multiple metrics in a single frame, which makes Bitcoin analysis and investment decision making more simplified.

For a deeper look on this topic, see a recent YouTube video here: the official Bitcoin EveryTHing indicator

Why do we need an integral indicator

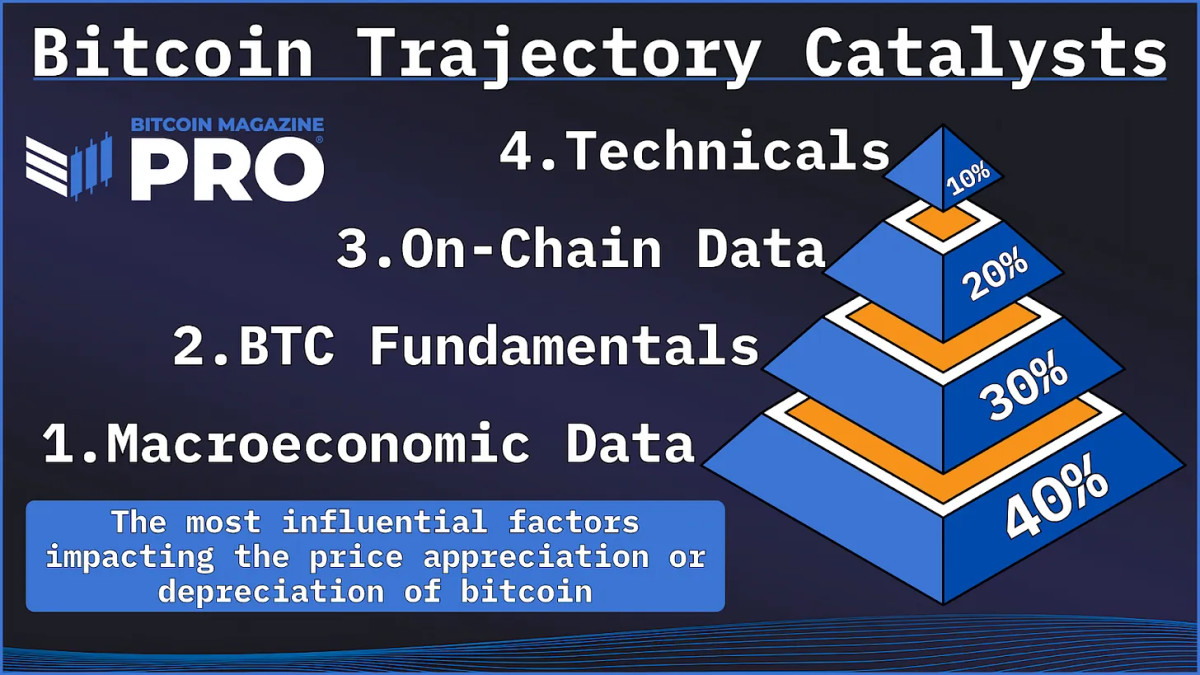

Investors and analysts generally trust several metrics, such as chain data, technical analysis and derivative graphics. However, focusing too much on one aspect can lead to an incomplete understanding of Bitcoin’s price movements. The bitcoin indicator tries to solve this by integrating key components into a transparent metric.

See live graphic 🔍

The central components of the Bitcoin indicator all

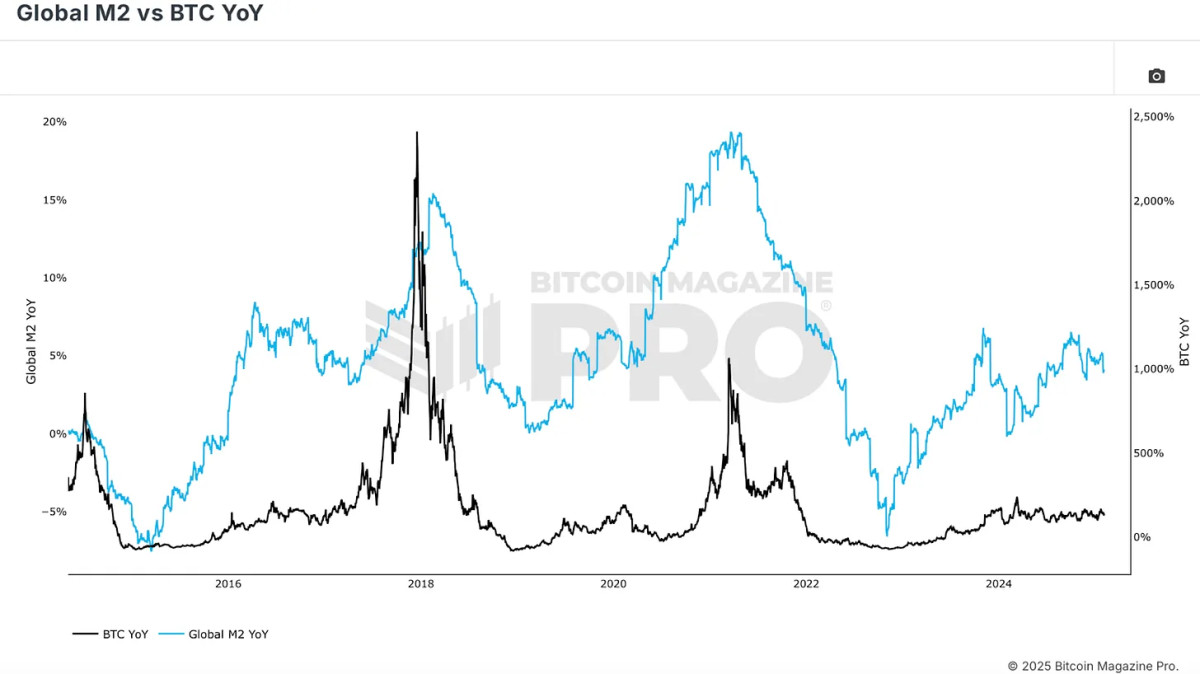

Bitcoin’s price action is deeply influenced by global liquidity cycles, which makes macroeconomic conditions a fundamental pillar of this indicator. The correlation between Bitcoin and the broader financial markets, especially in terms of global M2 monetary supply, is clear. When liquidity expands, Bitcoin is generally appreciated.

See live graphic 🔍

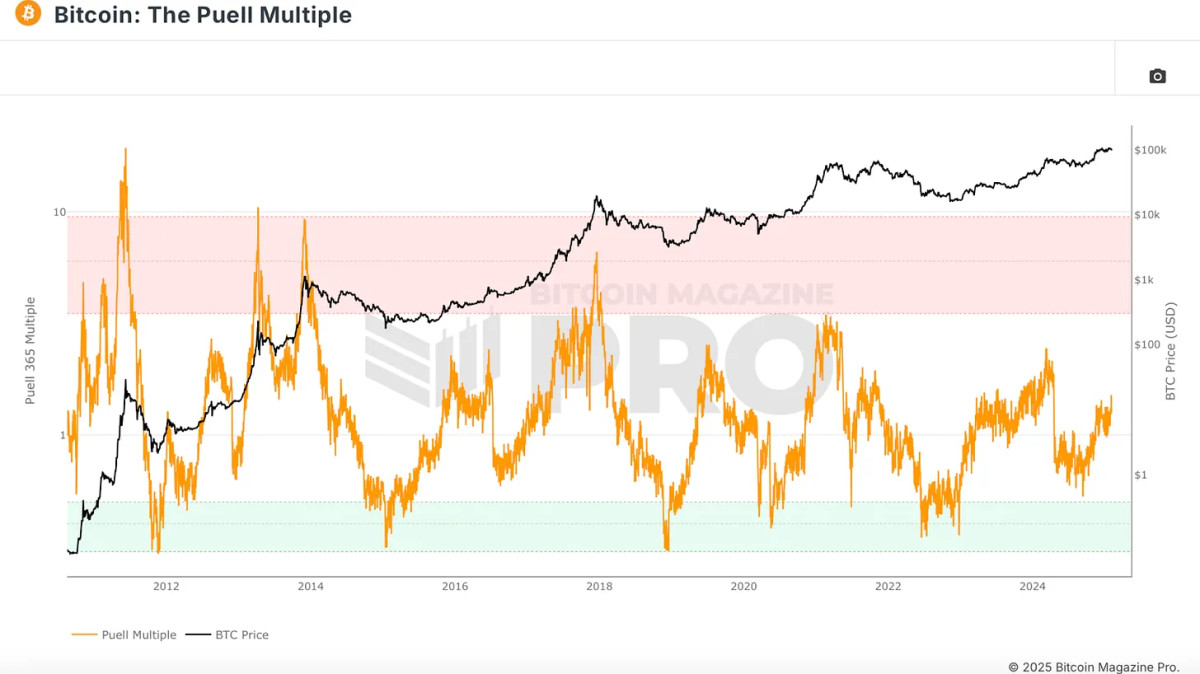

Fundamental factors such as cycles in the middle of Bitcoin and the strength of the miner play an essential role in its assessment. While halvings decrease Bitcoin’s new offer, its impact on price appreciation has decreased since more than 94% of Bitcoin’s total supply is already in circulation. However, miner’s profitability remains crucial. The PUELL multiple, which measures the income of miners in relation to historical averages, provides information on market cycles. Historically, when miner’s profitability is strong, Bitcoin tends to be in a favorable position.

See live graphic 🔍

The indicators in the chain help to evaluate the dynamics of the supply and demand of Bitcoin. The Z MVRV score, for example, compares the Bitcoin market limit with its limit made (average purchase price of all currencies). This metric identifies the accumulation and distribution zones, highlighting when Bitcoin is overvalued or undervalued.

See live graphic 🔍

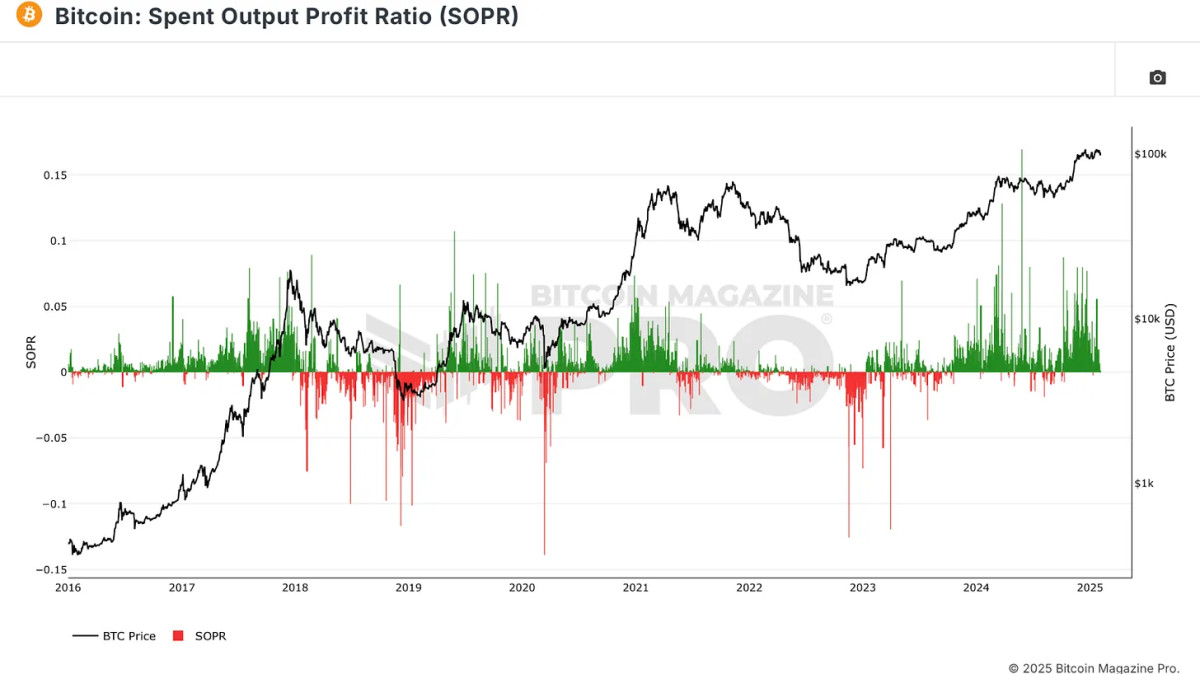

Another critical metric in the chain is the gain of worn gain (SOPR), which examines the profitability of the worn currencies. When Bitcoin holders get massive gains, it often indicates a market peak, while high losses indicate a market fund.

See live graphic 🔍

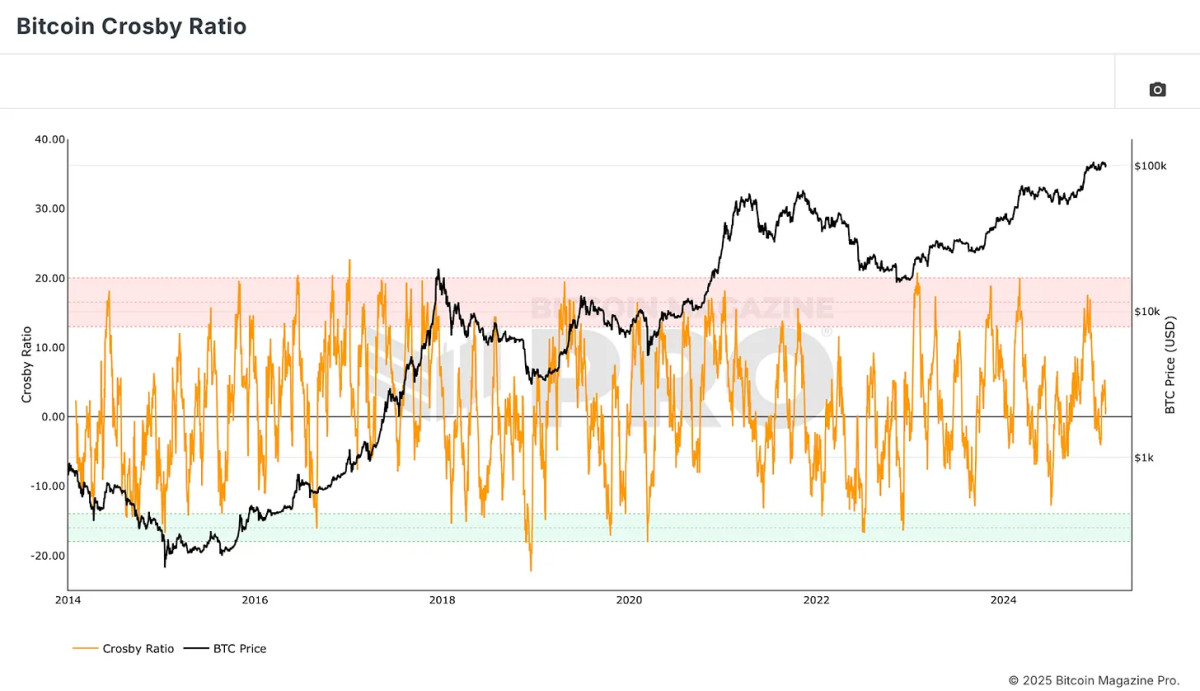

The Bitcoin Crosby ratio is a technical metric that evaluates the overextended or with bitcoin discount depending on the price action. This ensures that the feeling and impulse of the market are also taken into account in the Bitcoin indicator everything.

See live graphic 🔍

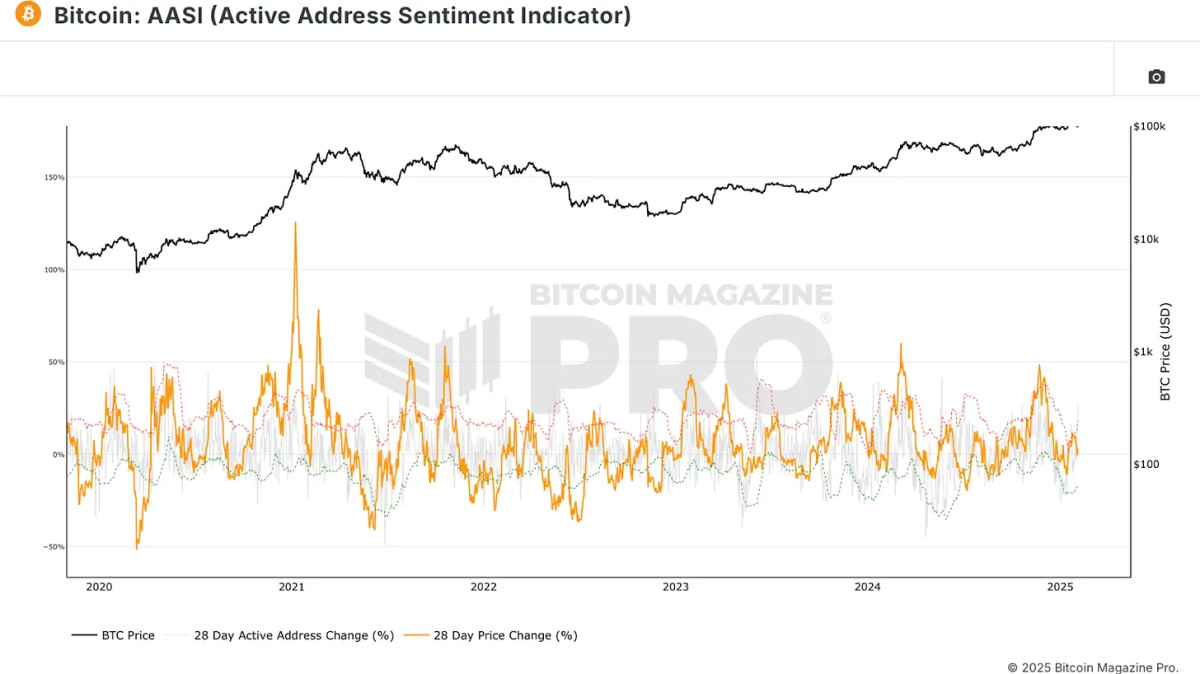

The use of the network can offer vital clues about Bitcoin’s force. The Active Directorate feeling indicator measures the percentage change in active addresses for 28 days. An increase in active addresses generally confirms an upward trend, while stagnation or decline may indicate the weakness of prices.

See live graphic 🔍

How the entire bitcoin indicator works

When combining these diverse metrics, the indicator of all Bitcoin everything ensures that no unique factor has an improper weight. Unlike the models that depend too much on specific signals, such as the Z MVRV score or the upper part of the Pi cycle, this indicator distributes the influence equally in multiple categories. This avoids the overjuste and allows the model to adapt to the changing conditions of the market.

Historical performance versus purchase and retention strategy

One of the most striking findings is that the indicator of everything has surpassed a simple purchase and retention strategy since Bitcoin was valued at less than $ 6. Using a Bitcoin accumulating strategy during oversight conditions and gradually selling in areas Of overload, investors who use this model would have significantly increased the performance of their portfolio with lower reduction.

For example, this model maintains a 20% reduction compared to the decreases of 60-90% typically observed in the history of Bitcoin. This suggests that a well -balanced and data driven approach can help investors make more informed decisions with a low risk.

Conclusion

The Bitcoin indicator all simplifies the investment by merging the most critical aspects that influence Bitcoin’s price action in a single metric. Historically it has surpassed the purchase and retention strategies while mitigating the risk, so it is a valuable tool for retail and institutional investors.

For a more detailed Bitcoin analysis and to access advanced features such as live graphics, alerts of personalized indicators and in -depth industry reports, see Bitcoin Pro Magazine.

Discharge of responsibility: This article is only for informative purposes and financial advice should not be considered. Always do your own research before making investment decisions.