Introduction

BRC-20 tokens are an experimental token standard designed to enable fungible tokens on the Bitcoin blockchain. Inspired by Ethereum’s ERC-20 tokens, BRC-20 tokens utilize the Bitcoin Ordinals protocol to inscribe data onto individual satoshis, making them transferable and tradable. However, unlike Ethereum’s smart contract-based tokens, BRC-20 tokens operate without smart contracts, leading to both advantages and limitations.

Origins of BRC-20 Tokens

The BRC-20 standard was introduced by a pseudonymous developer known as Domo in March 2023, shortly after Casey Rodrigo launched the Bitcoin Ordinals protocol in January 2023. Ordinals allowed users to inscribe data onto individual satoshis, enabling the creation of NFTs on Bitcoin.

The first-ever BRC-20 token, ORDI, quickly gained popularity, leading to the creation of numerous other BRC-20 tokens. This new token standard aimed to bring fungible token functionality to Bitcoin, much like ERC-20 did for Ethereum. However, due to Bitcoin’s lack of smart contract capabilities, BRC-20 tokens function differently from ERC-20 tokens.

How Do BRC-20 Tokens Work?

BRC-20 tokens operate using the Ordinal protocol to inscribe JSON data onto individual satoshis. These inscriptions define key token properties such as:

- Deployment: The initial creation of a BRC-20 token involves inscribing a JSON file onto a satoshi. This file contains details such as the token’s name, total supply, and minting rules.

- Minting: After deployment, users can mint tokens based on predefined rules. Minted tokens are also inscribed onto satoshis.

- Transfer: Instead of using smart contracts, BRC-20 tokens are transferred by creating new inscriptions that specify the transaction details. These transactions are recorded immutably on the Bitcoin blockchain.

Pros and Cons of BRC-20 Tokens

Pros:

✅ Simplicity – Since they don’t use smart contracts, BRC-20 tokens are easier to create and transfer.

✅ Security – Transactions are recorded on Bitcoin’s highly secure blockchain, ensuring immutability and trust.

✅ Accessibility – Anyone can create and transfer BRC-20 tokens using simple JSON inscriptions.

Cons:

❌ Lack of Smart Contracts – The inability to execute complex logic limits their potential use cases.

❌ Network Congestion – BRC-20 inscriptions increase Bitcoin network congestion, leading to higher transaction fees.

❌ Limited Interoperability – Unlike ERC-20 tokens, BRC-20 tokens are designed exclusively for Bitcoin and cannot interact with other blockchain ecosystems.

Use Cases of BRC-20 Tokens

Despite their limitations, BRC-20 tokens have been explored for various applications, including:

- Decentralized Applications (dApps) – Developers can create tokens for in-app utility, governance, or rewards.

- Tokenized Assets – Companies can represent stocks, real estate, or commodities as BRC-20 tokens on Bitcoin.

- Loyalty Points Systems – Businesses can issue loyalty rewards using BRC-20 tokens for transparency and fraud prevention.

- Community Tokens – Groups can create tokens for event participation, governance voting, or reward distribution.

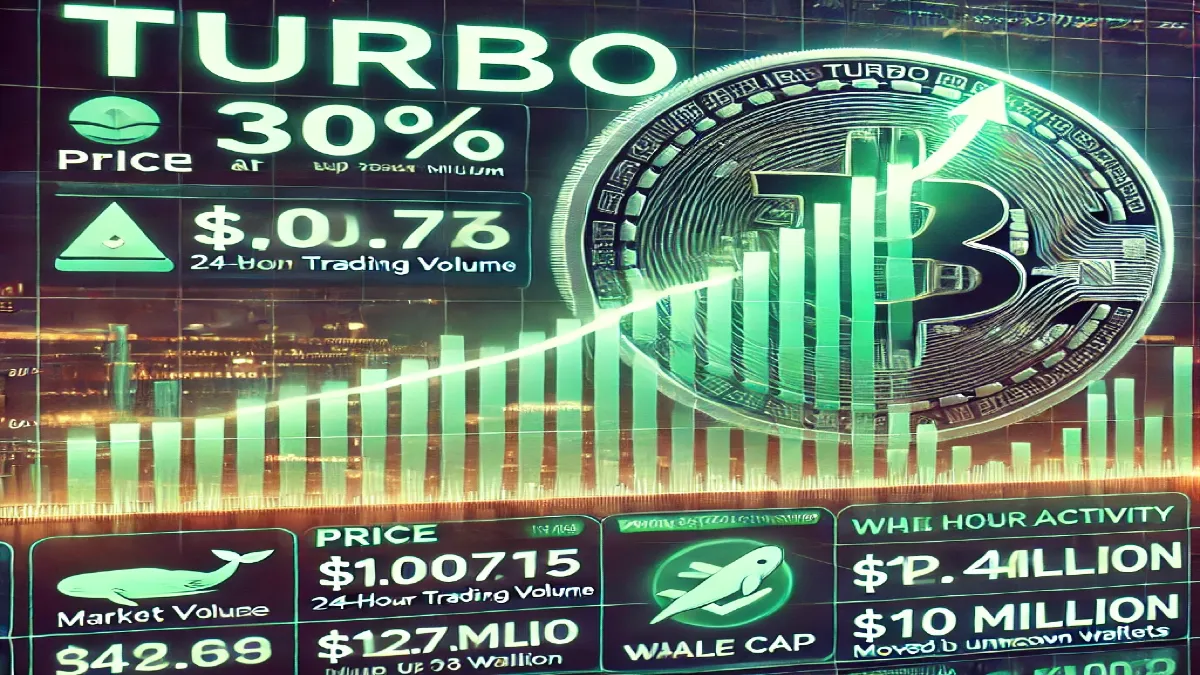

However, in practice, most BRC-20 tokens are used for speculation and meme coin trading rather than real-world applications.

Rune Protocol: A More Efficient Alternative

A newer token standard called Rune Protocol, introduced by Casey Rodarmor, provides a more efficient and scalable alternative to BRC-20. Unlike BRC-20 tokens, Rune Protocol leverages Bitcoin’s UTXO model and the OP_RETURN function, reducing network congestion and improving transaction speed.

Additionally, Rune tokens integrate more seamlessly with Bitcoin’s Lightning Network, making them a superior choice for developers looking to issue tokens on Bitcoin.

Also Read : https://bitcoinnewspro.com/?s=Meme&i=1

Final Thoughts

While BRC-20 tokens have introduced fungible assets to the Bitcoin blockchain, they suffer from inefficiencies, high fees, and speculative use. Newer innovations like Rune Protocol may offer a more practical approach for tokenization on Bitcoin.